Get Started

get-started.Rmd

library(abslife)

#> Welcome to the abslife package!

#> WARNING: Under construction.

library(ggplot2) ## optionalThis package is currently under construction!

This vignette demonstrates the core functionalities of the

abslife package. abslife provides tools for

estimation of the hazard rate, denoted \(\lambda\), for discrete time-to-event data

subject to left-truncation (Jackson P. Lautier, Pozdnyakov, and Yan 2023a).

The package is designed so it can additionally handle the following

common observational data challenges:

+ Right-censoring (Jackson P. Lautier, Pozdnyakov, and Yan 2023b)

+ Competing risks (Jackson P. Lautier, Pozdnyakov, and Yan 2024)

In all cases, asymptotic confidence intervals for the estimated

hazard rates are readily available. The main function of the package is

the estimate_hazard() function, which adapts to these

scenarios based on the arguments provided.

Now, we provide specific examples with datasets shipped with the package.

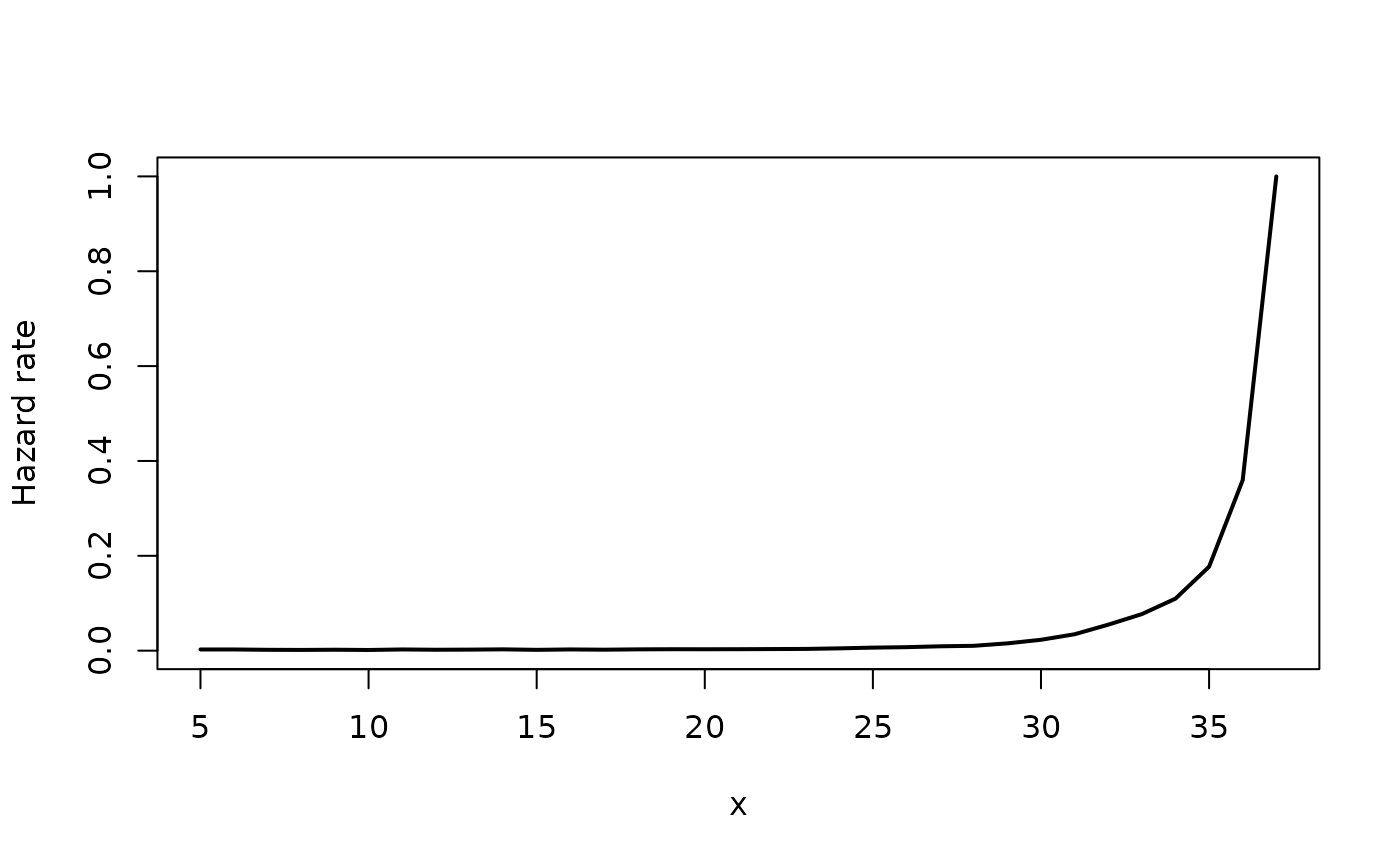

Left-truncation

We begin by analyzing the aart dataset. This dataset represents a

scenario involving only left-truncation. It contains two columns:

Xi (time-to-event) and Yi (truncation

time).

We estimate the hazard rate using estimate_hazard().

aart_hazard <- estimate_hazard(lifetime = aart$Xi,

trunc_time = aart$Yi,

ci_level = 0.95,

carry_hazard = TRUE) ## need Note that we set

carry_hazard = TRUE. This argument ensures that if a hazard estimate is 0, it is replaced by the last non-zero estimate.

The function returns a data.frame containing the

evaluation times, the hazard estimates, and the standard errors (on the

log scale). It also includes the lower and upper bounds of the

confidence interval corresponding to the ci_level argument

(in this case, set to 0.95).

tail(aart_hazard)

#> Observed lifetime support: [44, 49]

#> Total number of timepoints observed: 6Summarizing and plotting

For a concise overview of the estimation, use the

summary() method:

summary(aart_hazard)

#> lifetime hazard se_log_hazard lower_ci upper_ci

#> 1 5 0.01904762 0.7139389 0.004768819 0.07294634

#> 6 10 0.01556420 0.3563373 0.007802303 0.03080805

#> 11 15 0.02432778 0.2322583 0.015569867 0.03782269

#> 16 20 0.01724138 0.2604539 0.010420226 0.02839956

#> 21 25 0.02956705 0.1918396 0.020490707 0.04248937

#> 26 30 0.03311966 0.1826555 0.023386182 0.04671051

#> 31 35 0.05163330 0.1466945 0.039237648 0.06766907

#> 36 40 0.73134328 0.2756152 0.613311320 0.82370364

#> 41 45 0.50000000 1.4142136 0.058866787 0.94113321To visualize the hazard rate, you can use base R graphics via the

plot() method:

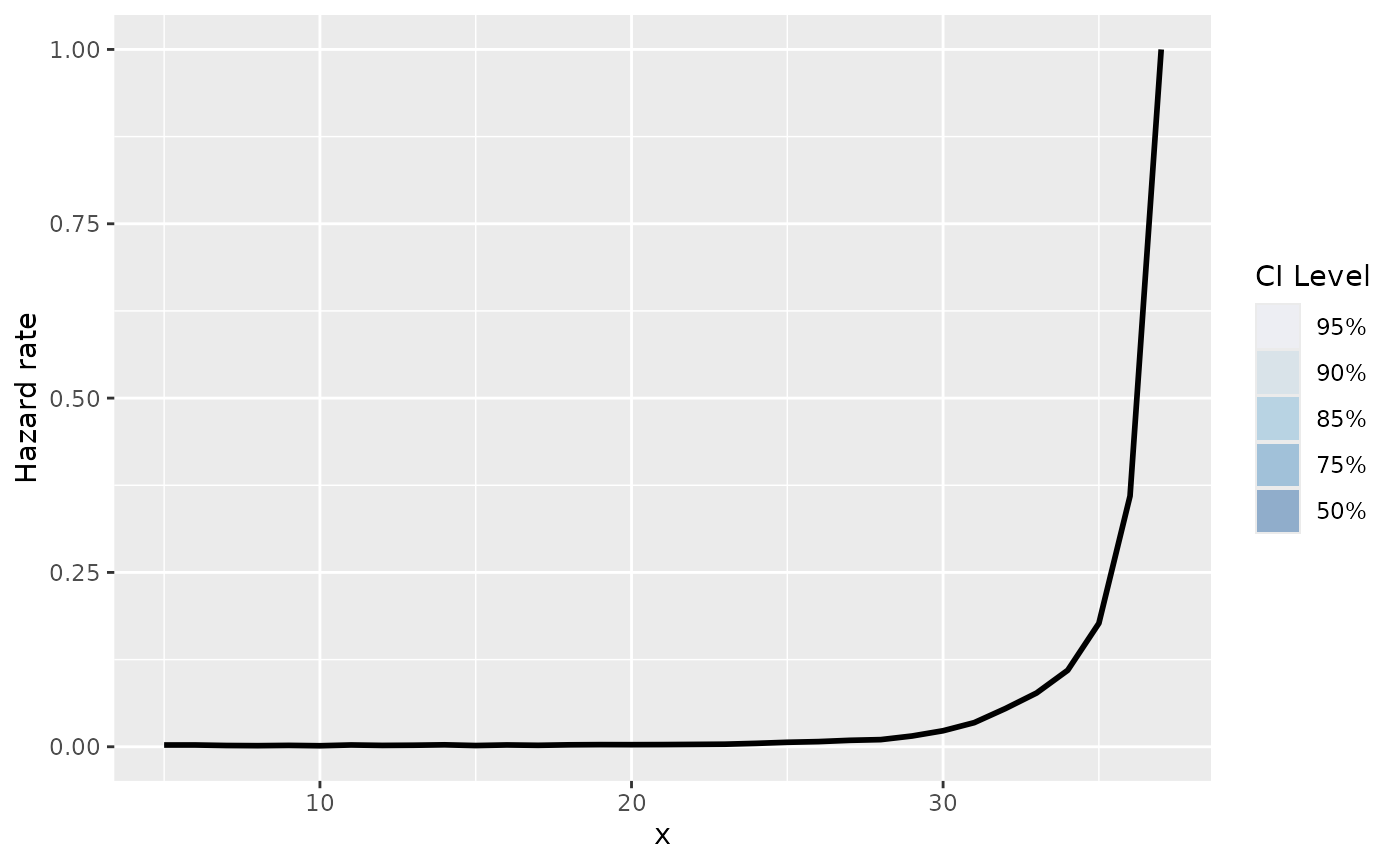

Alternatively, use ggauto() for a

ggplot2-powered visualization. This function is

particularly useful for visualizing multiple confidence levels

simultaneously:

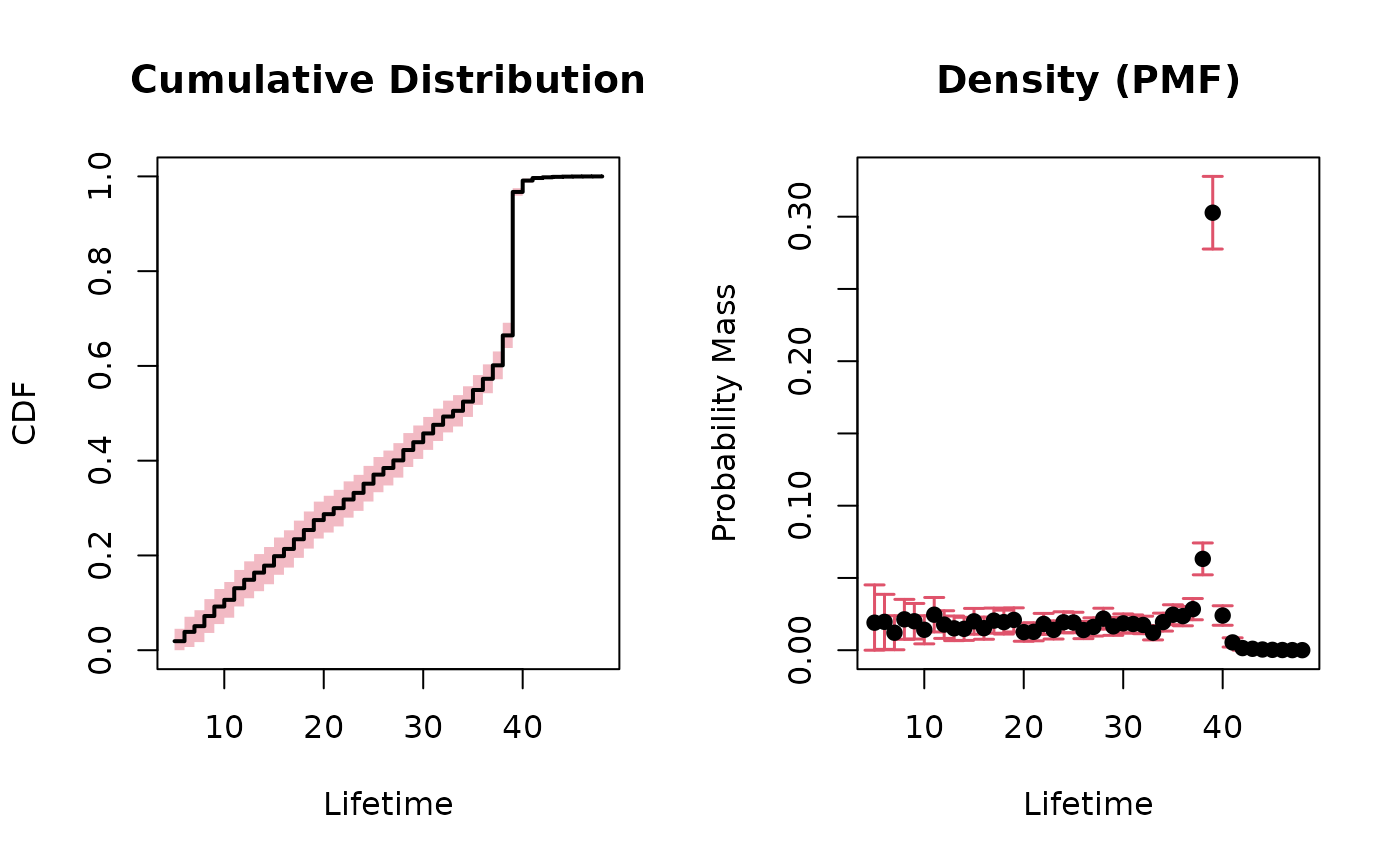

Calculating the CDF

The package can also derive the Cumulative Distribution Function

(CDF) directly from the hazard estimates using calc_cdf().

This appends a cdf column to the results.

aart_cdf <- calc_cdf(aart_hazard)

#> Warning in calc_cdf.alife(aart_hazard): Not reporting CDF (and density) values

#> for time points where the hazard rate equals 1.

summary(aart_cdf)

#> lifetime cdf density

#> 1 5 0.01904762 0.0190476190

#> 6 10 0.10628735 0.0141298442

#> 11 15 0.19848679 0.0199852375

#> 16 20 0.28713123 0.0125064696

#> 21 25 0.37058116 0.0191770702

#> 26 30 0.45756023 0.0185808099

#> 31 35 0.54922672 0.0245421009

#> 36 40 0.99118211 0.0240042534

#> 41 45 0.99975506 0.0002449414We can also plot the CDF:

plot(aart_cdf)

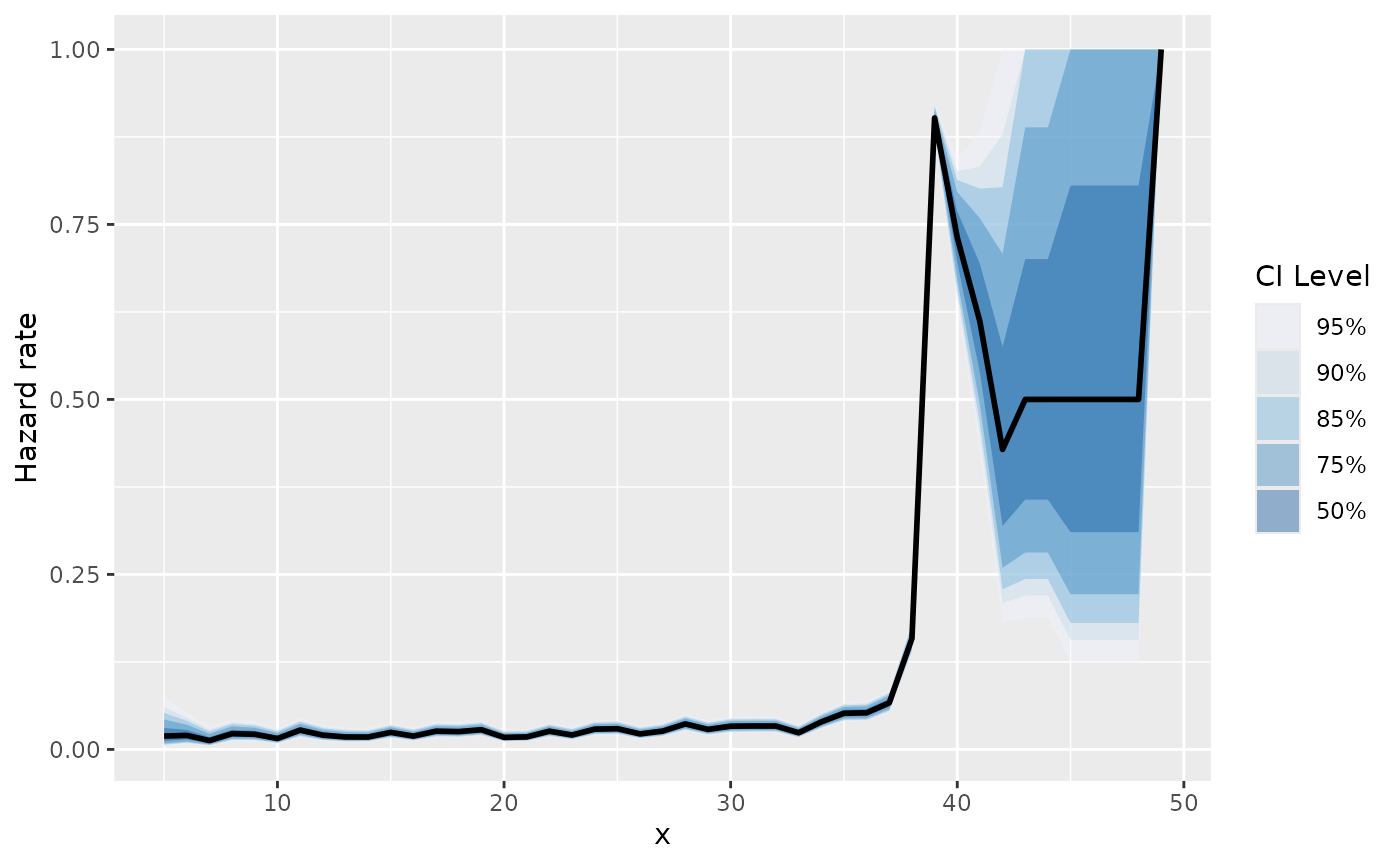

Right-censoring

The workflow for right-censored data is nearly identical. We will

demonstrate this using the mbalt dataset, which includes a

third column, Di, serving as the right-censoring

indicator.

data(mbalt)

head(mbalt)

#> Zi Yi Di

#> 1 37 29 1

#> 2 30 29 1

#> 3 37 30 1

#> 4 32 32 1

#> 5 37 32 1

#> 6 36 33 1We call estimate_hazard() again, but this time we

provide the censoring argument. This argument accepts a vector where

1 indicates a censored observation and 0

indicates an observed event.

mbalt_hazard <- estimate_hazard(lifetime = mbalt$Zi,

trunc_time = mbalt$Yi,

censoring = 1 - mbalt$Di,

ci_level = 0.95,

carry_hazard = FALSE) ## need The output structure remains consistent with the previous example.

summary(mbalt_hazard)

#> lifetime hazard se_log_hazard lower_ci upper_ci

#> 1 5 0.002508511 0.26759709 0.0014862156 0.004231014

#> 6 10 0.001434144 0.20014357 0.0009692424 0.002121564

#> 11 15 0.001737138 0.14599185 0.0013054299 0.002311282

#> 16 20 0.002970103 0.09727315 0.0024558192 0.003591697

#> 21 25 0.006408170 0.06270122 0.0056713262 0.007240052

#> 26 30 0.022951205 0.03238299 0.0215702141 0.024418405

#> 31 35 0.177075260 0.01673112 0.1723472557 0.181904461The plotting functions also work out of the box:

plot(mbalt_hazard)

and, for ggplot2:

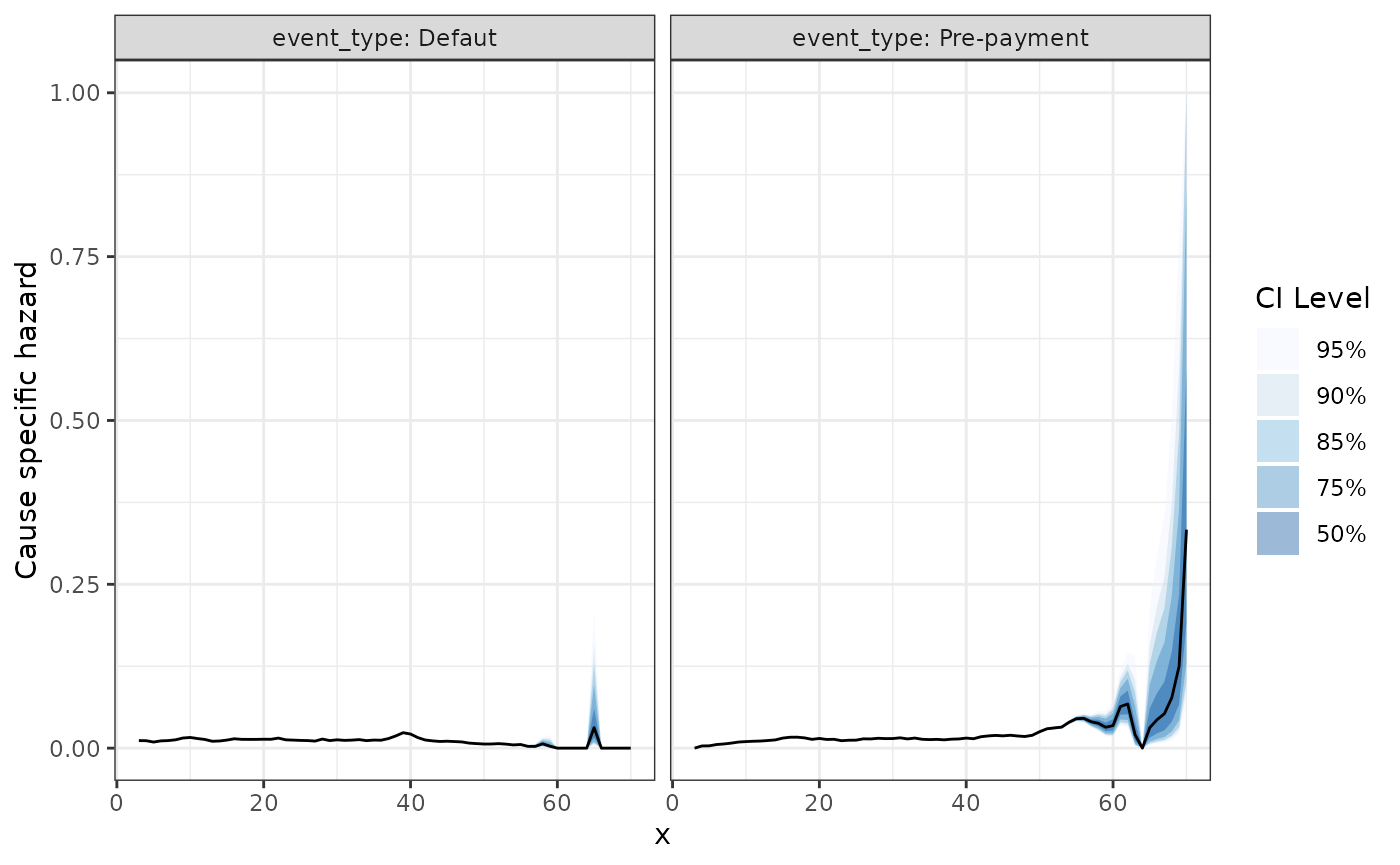

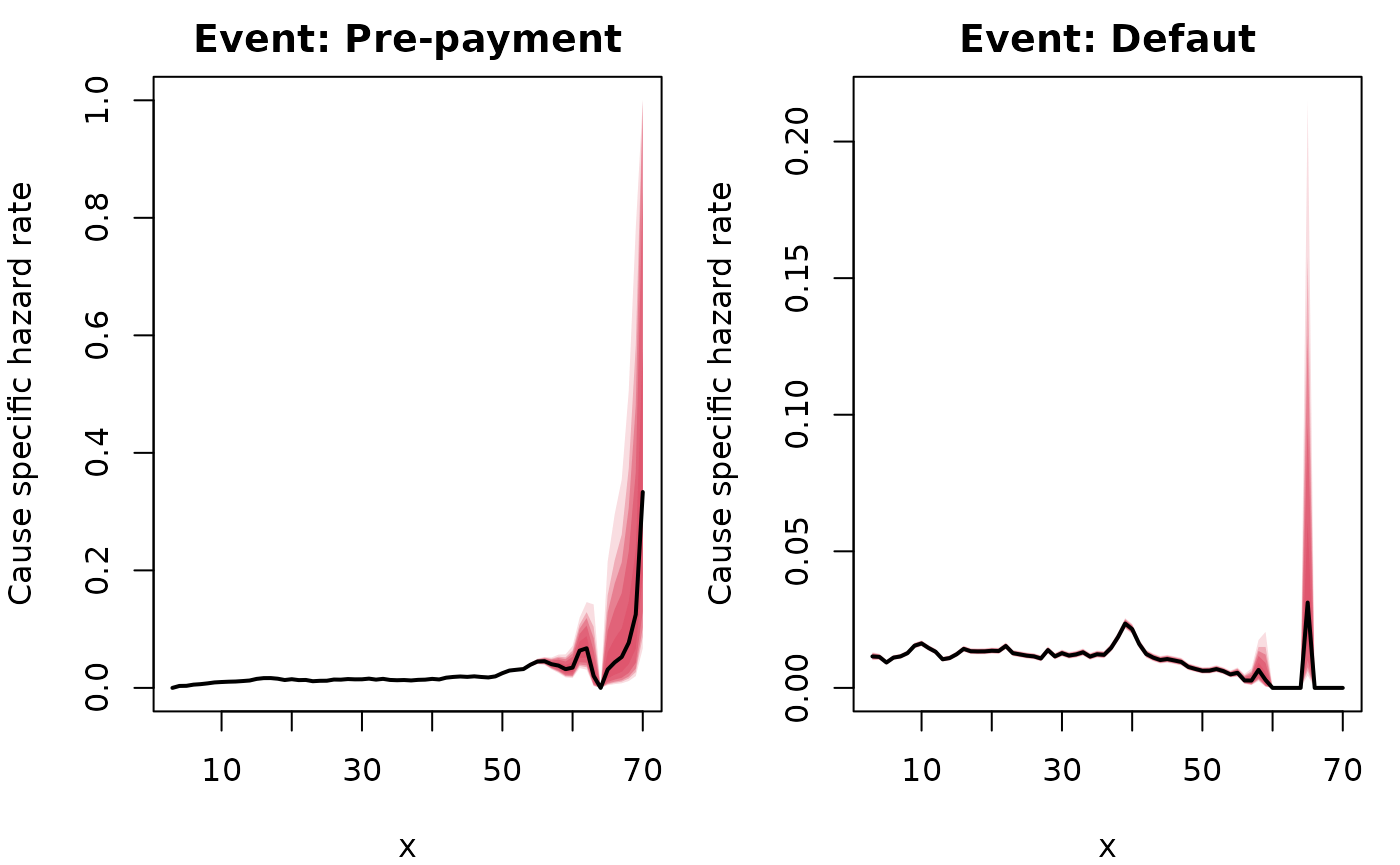

Competing risks

Finally, abslife can estimate hazards in the presence of

competing risks. We use the aloans dataset, which contains data on

consumer automobile loans (Jackson P. Lautier,

Pozdnyakov, and Yan 2024).

data(aloans)

head(aloans)

#> risk_cat Z Y C D R bond

#> 1 subprime 42 19 0 0 1 sdart

#> 2 subprime 50 19 0 1 0 sdart

#> 3 near_prime 23 19 0 1 0 sdart

#> 4 prime 70 19 1 0 0 sdart

#> 5 subprime 21 19 0 1 0 sdart

#> 6 prime 70 19 0 0 1 sdartThe relevant columns of the dataset for this example are the following:

Z: time to eventY: left-truncationC: right censoring indicatorD: Default indicator (1 represents default, and 0 represents pre-payment)

The two competing risks in this case are default and pre-payment. To make the results more interpretable, we create a descriptive event_type column.

The package is designed so the workflow is identical as the previous

two examples. The only change here is passing the column discriminating

the event types to the event_type argument in

estimate_hazard().

aloans_hazard <- estimate_hazard(lifetime = aloans$Z,

trunc_time = aloans$Y,

censoring = aloans$C,

event_type = aloans$event_type,

ci_level = 0.95,

carry_hazard = FALSE) ## need

#> Warning in check_censored(lifetime, censoring_indicator, support_lifetime_rv):

#> Warning: Detected censored observations at the maximum limit of the support

#> (lifetime == max(support_lifetime_rv)). This may lead to identifiability issues

#> or unstable hazard estimates at the tail.The output now includes a column specifying the event type for each hazard estimate.

summary(aloans_hazard)

#> event_type lifetime hazard se_log_hazard lower_ci upper_ci

#> 1 Defaut 3 0.011520293 0.06506047 0.010155080 0.013066617

#> 2 Defaut 8 0.012729470 0.03876609 0.011809112 0.013720562

#> 3 Defaut 13 0.010477761 0.04486786 0.009604176 0.011429888

#> 4 Defaut 18 0.013350256 0.04224199 0.012302520 0.014485913

#> 5 Defaut 23 0.012722853 0.04637351 0.011630319 0.013916572

#> 6 Defaut 28 0.013859145 0.04731310 0.012647271 0.015185355

#> 7 Defaut 33 0.013032176 0.05225905 0.011778374 0.014417499

#> 8 Defaut 38 0.018664205 0.04681281 0.017055857 0.020421067

#> 9 Defaut 43 0.011084154 0.06587830 0.009754619 0.012592597

#> 10 Defaut 48 0.007673623 0.08514621 0.006501842 0.009054661

#> 11 Defaut 53 0.006133755 0.10401466 0.005008188 0.007510380

#> 12 Defaut 58 0.006600660 0.50165838 0.002479550 0.017451386

#> 13 Defaut 63 0.000000000 Inf 0.000000000 NaN

#> 14 Defaut 68 0.000000000 Inf 0.000000000 NaN

#> 15 Pre-payment 3 0.000000000 Inf 0.000000000 NaN

#> 16 Pre-payment 8 0.007686787 0.04975978 0.006977496 0.008467566

#> 17 Pre-payment 13 0.011646595 0.04258207 0.010724035 0.012647505

#> 18 Pre-payment 18 0.015630141 0.03908499 0.014494211 0.016853574

#> 19 Pre-payment 23 0.011372231 0.04901653 0.010341306 0.012504631

#> 20 Pre-payment 28 0.015052316 0.04542667 0.013787747 0.016430935

#> 21 Pre-payment 33 0.015385696 0.04815372 0.014019446 0.016882814

#> 22 Pre-payment 38 0.013687084 0.05452748 0.012316859 0.015207396

#> 23 Pre-payment 43 0.018648019 0.05098525 0.016904597 0.020567482

#> 24 Pre-payment 48 0.017776306 0.05622984 0.015950891 0.019806416

#> 25 Pre-payment 53 0.032053819 0.04610587 0.029365598 0.034979259

#> 26 Pre-payment 58 0.037953795 0.21258769 0.025348580 0.056464133

#> 27 Pre-payment 63 0.020408163 1.01036297 0.002867406 0.131138926

#> 28 Pre-payment 68 0.076923077 1.04083300 0.010719623 0.390571292The plotting functions work as in the previous examples, handling the stratification by event type automatically:

The same holds for the ggplot2 powered plots: